In-Ovo Sexing Australian Consumer Survey

A recent consumer survey commissioned by Innovate Animal Ag reveals strong Australian market demand for eggs produced using in-ovo sexing technology. The results indicate that egg producers who adopt this technology will find a consumer base willing and eager to pay premium prices.

The survey, conducted by Ipsos from August 7-10th, 2025, sampled 1,000 Australian consumers who were responsible for at least 50% of their household grocery purchases.

Some highlights from the survey:

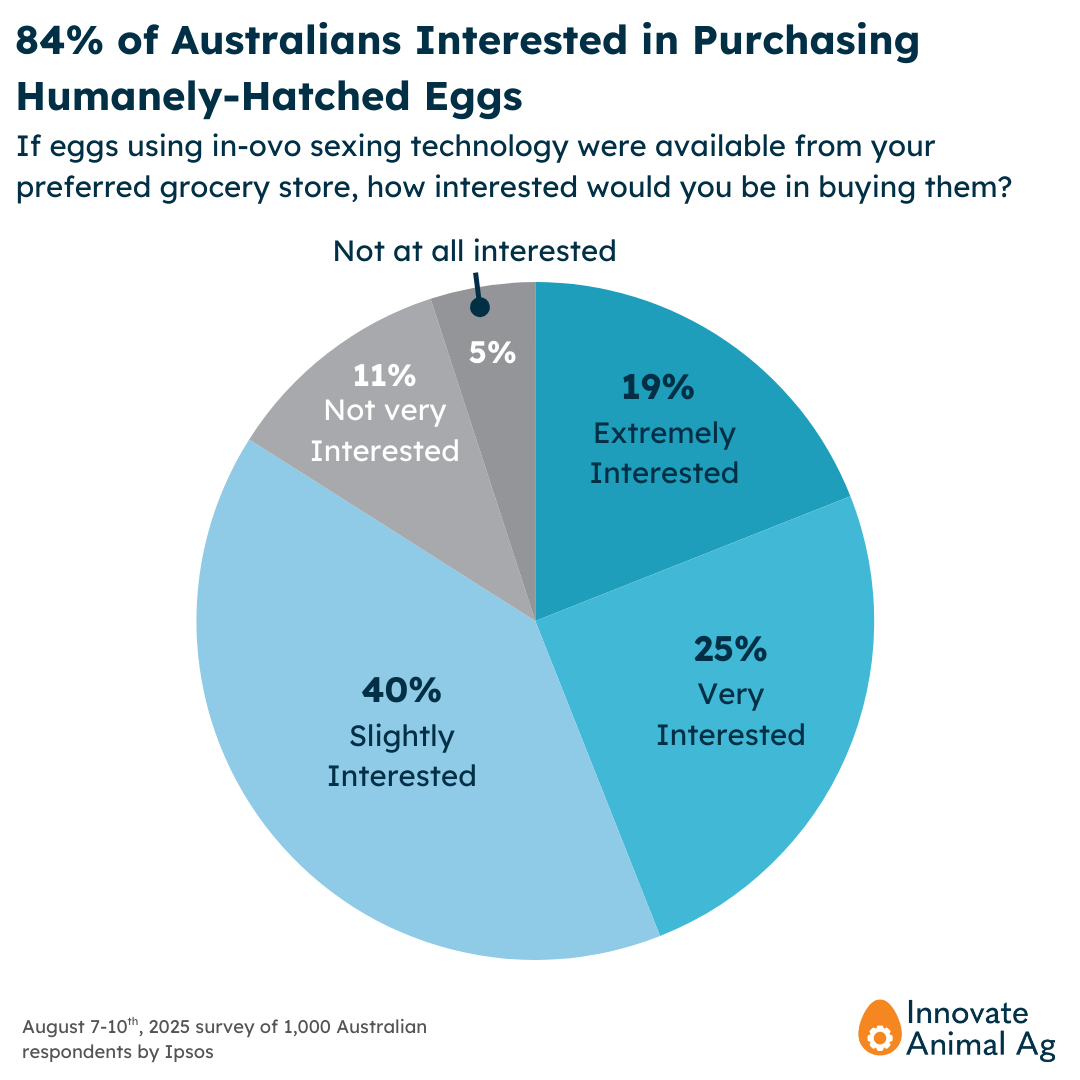

84% of respondents expressed interest in purchasing in-ovo sexed eggs for their household, with 44% indicating they were “very” or “extremely” interested.

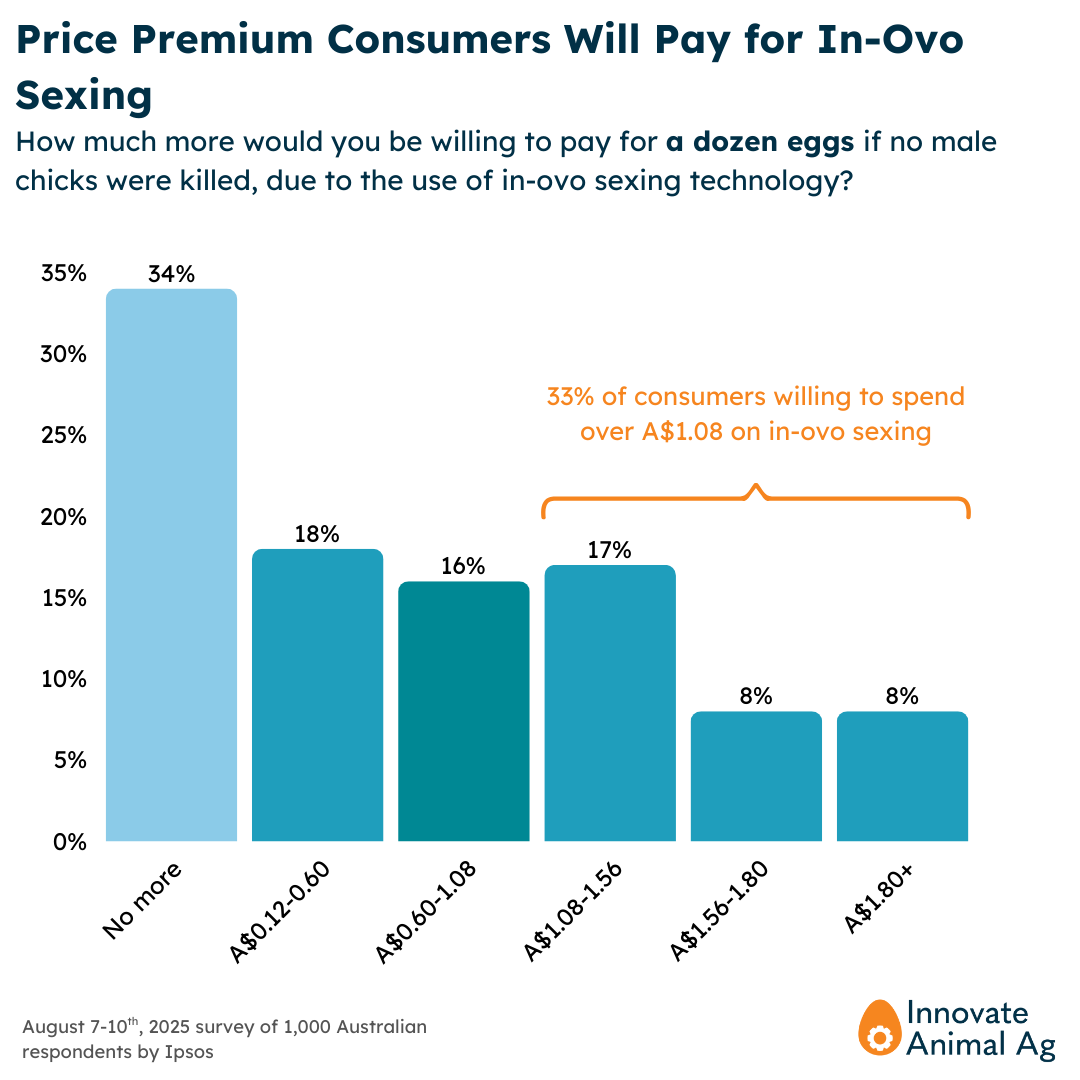

66% of respondents were willing to pay a premium for eggs made without chick culling, reporting an average premium of A$0.93 per dozen or over 7 cents per egg.

48% of consumers said they would likely leave their regular egg brand for a brand that uses in-ovo sexing, with one fifth of consumers (19%) reporting they would be “very likely” to switch. 33% of consumers would even consider switching grocery stores in order to buy eggs produced with in-ovo sexing.

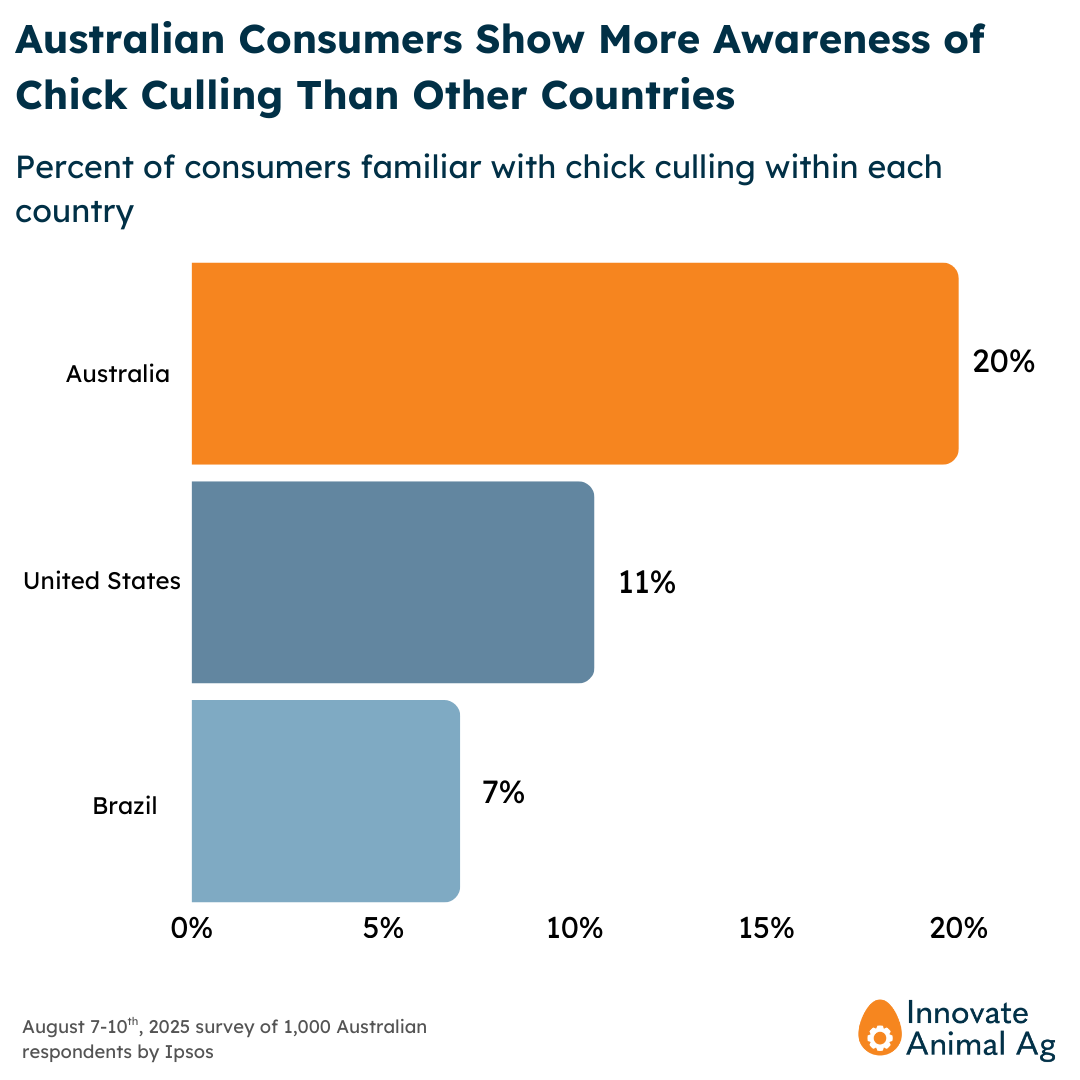

20% of respondents knew about male chick culling, almost double the awareness of the US or Brazil. When informed, 73% of respondents believed that the egg industry should adopt in-ovo sexing technology.

The Business Case

Results from the survey suggest that Australia will have a strong consumer market for in-ovo sexing. Around two-thirds of surveyed consumers (66%) expressed interest in paying more for eggs made without chick culling, averaging A$0.93 (0.60 USD) more per dozen. While self-reported willingness to pay data is not a perfect analog of consumer demand, there is a striking difference between how much consumers say they will pay for in-ovo sexing and how much the technology costs.

Assuming 400 eggs per hen, in-ovo sexing adds approximately 6.9 cents AUD per dozen for brown layers (which comprise 90% of the Australian flock). That means the average consumer premium is 13.5 times the added cost of in-ovo sexing for brown layers. It’s notable that in-ovo sexing is significantly cheaper than other specialty egg types, like cage-free and pasture-raised, allowing producers a cheap entry into the premium egg market.

Consumer responses suggest that in-ovo sexing could be a way to win over new customers. Almost half of consumers (48%) said they would likely leave their regular egg brand for a brand that uses in-ovo sexing, with one fifth of consumers (19%) reporting they would be “very likely” to switch. Beyond just switching brands, 33 out of every 100 consumers would even consider switching grocery stores in order to buy eggs produced with in-ovo sexing. These numbers suggest that chick culling plays a surprisingly influential role in grocery decisions once consumers are made aware of it.

Awareness of Chick Culling

The survey suggests that Australian consumers are more aware of chick culling than consumers in other countries. While the majority of the Australian public is still unaware of the practice, 20% of consumers correctly identified that male chicks are culled shortly after hatching. This is significantly higher than the 11% of Americans and 7% of Brazilians that were aware of the current culling practice. Producers who introduce in-ovo sexing to the Australian market may find a significant base of consumers who already understand the value proposition of the technology.

Past research conducted by IAA has shown that the majority of consumers have strong negative reactions to chick culling upon learning about it. Although current levels of awareness remain low, international data also suggests that consumer awareness has been steadily increasing over the past few years. As awareness increases, so too will demand for solutions. The combination of growing consumer interest, manageable production costs, and substantial willingness to pay suggests a promising market opportunity for Australian egg producers.