We Used AI to Analyze New York Times Comments on In-Ovo Sexing

The New York Times recently published an opinion piece on in-ovo sexing which garnered comments from over 170 people. In-depth AI analysis of these comments painted a very optimistic and nuanced picture of how consumers will react to this technology, despite the sensationalized depiction of the topic of chick culling in the article. Additionally, comments from consumers motivated to find this new category of eggs on the shelves received 73% more positive engagement than the average comment on the article, suggesting that increased consumer awareness will lead to more high-intent shoppers.

With the AI’s help, we also identified 3 key takeaways for producers and retailers:

The market opportunity exceeds added costs, by far.

Rather than just expressing outrage over the issue, consumers are happy to see brands and retailers adopt technology to solve this challenge.

Consumers will switch brands—and even grocery stores—to buy these eggs.

Collecting the Data

We asked OpenAI’s newest o3 AI model to analyze all 173 comments, focusing on takeaways for egg producers and retailers. In addition to looking at the sentiment within the comments themselves, we also asked the AI to take into account the amount of positive engagement each comment got, which is an indication of agreement from other readers of the comments. We manually reviewed the data collection and analysis to check for hallucination.

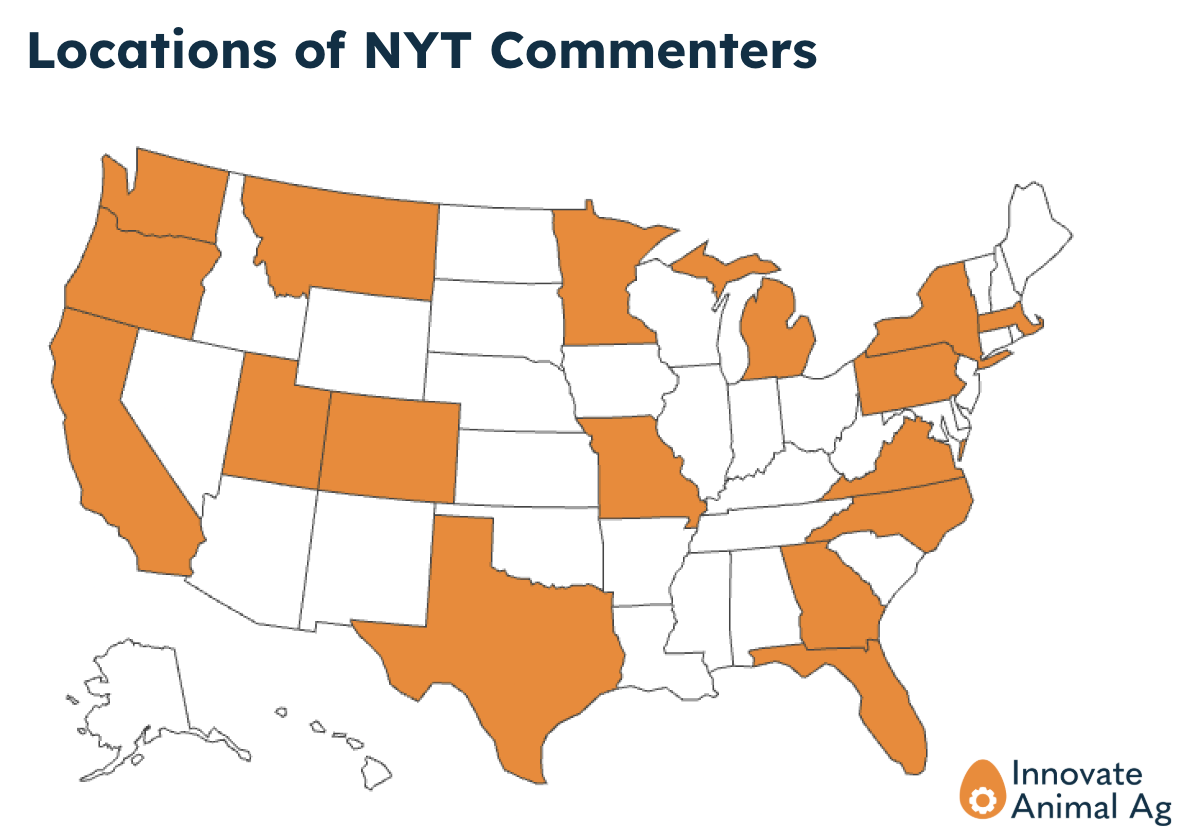

The 173 unique commentators came from 17 states, providing a diverse set of viewpoints from across American society. The commenters were 60% urban, 25% suburban, and 15% rural based on their provided location data. 7% of all commenters reported growing up on a farm or having worked on a commercial-farm at some point in their life.

12% of all comments expressed an unprompted and explicit willingness-to-pay. Comments of this sort received 62% more engagement than the average other comments.

18% of all comments expressed an explicit intent to look for eggs produced with in-ovo sexing on the shelf. Comments of this sort received 46% more engagement than the average comment to the article.

10 of the comments, or 7% of all comments, expressed explicitly that they would be willing to pay more for eggs produced without chick culling and that they intend to look for these eggs on grocery store shelves. These comments received, notably, 73% more positive engagement than the average other comments.

In contrast, comments that promoted veganism and encouraged not consuming eggs or comments that were skeptical of in-ovo sexing had engagement rates that were much lower than the average comment, at -22% and -67% respectively.

Analysis

The market opportunity exceeds the added costs, by far.

It was remarkable to see that 12% of all commenters expressed that they would be willing to pay more for eggs produced with in-ovo sexing. This is noteworthy since the commenters were unprompted which indicates substantial baseline demand. One commenter, Ron G. from Salinas, CA, expressed, for example, that it would be easily “worth the three cents per egg to avoid.”

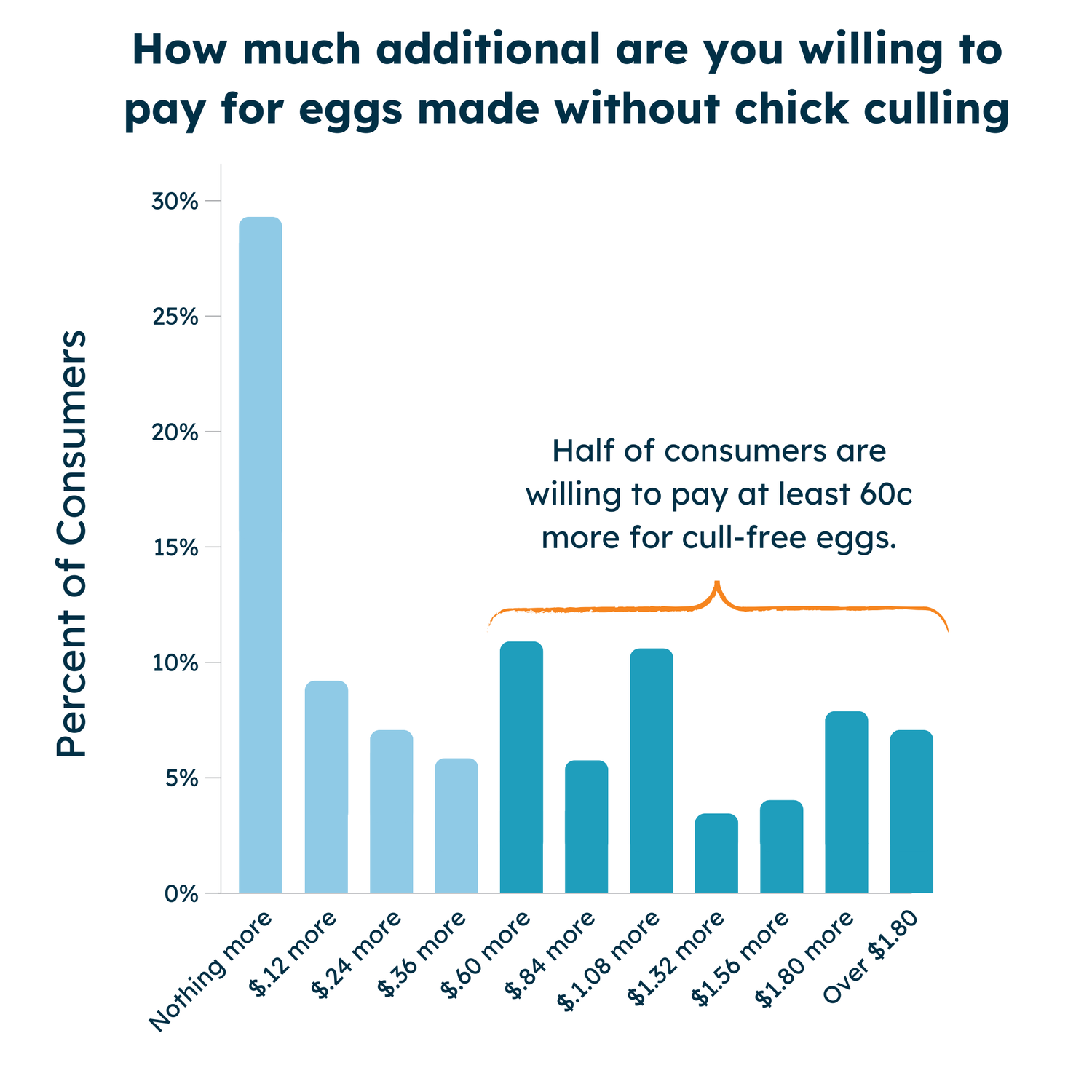

This is in accord with Innovate Animal Ag’s American Consumer survey which found that half of consumers would be willing to pay 5 cents or more per egg to eliminate male chick culling and more than 10% of consumers would pay 15 cents or more per egg for a brand that uses in-ovo sexing.

Americans are not unique in this strong preference either. Our recently launched survey of Brazilian consumers also found that more than 75% of consumers would be willing to pay more than in-ovo sexing’s cost per egg. Additionally, in data we analyzed from UK consumers, around half of consumers were willing to pay 10 pennies or more per egg.

This global agreement among consumers is all the more significant given that the cost of in-ovo sexing is less than a cent per egg, implying that not only would consumers be happy covering the added cost of the technology, but that there is also a shared surplus value that can be split between consumers, producers, and retailers.

Rather than just expressing outrage over the issue, consumers are happy to see brands and retailers adopt technology to solve this challenge.

Many commenters expressed ignorance or shock about the issue of chick culling, but that didn’t turn them away from eggs. In fact, 44% of these commenters expressed explicit purchase intent. One paradigmatic example is a comment from AMLH, from North Carolina. She writes that she is “still reeling from reading what happens to male chicks,” and that she “will look into the eggs described here. We absolutely must change this.” Though there are a minority of comments that are disparaging of the egg industry after learning about the practice, the majority of responses, like our commenter above, are much more pragmatic. DJH, a commenter from Detroit, provides another example of this: “This is very illuminating. Thank you for naming the brands that do in-ovo testing.”

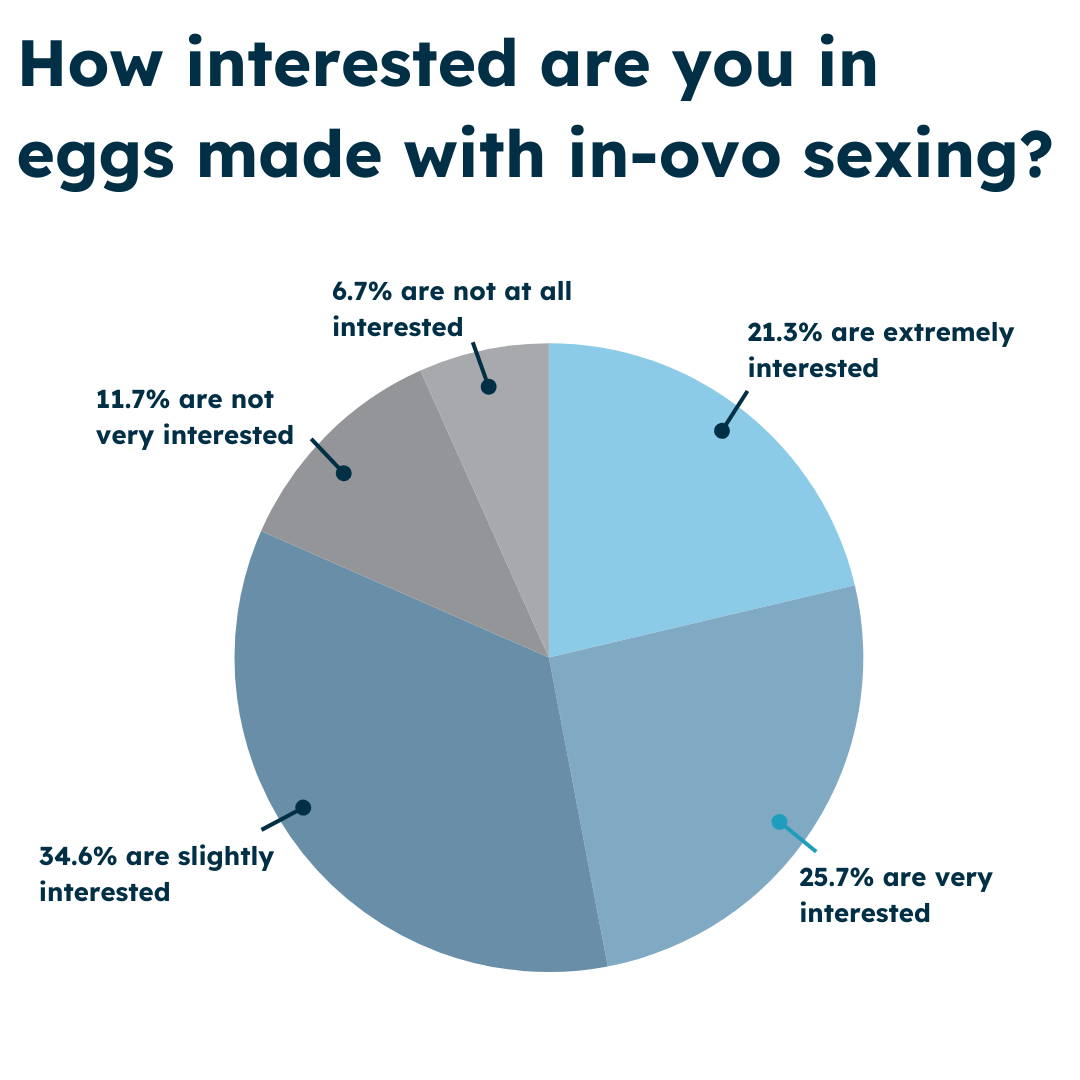

The data from our American Consumer Survey supports the idea that consumers will react positively towards producers who adopt the technology. After being informed about chick culling, 82% of the consumers surveyed express interest in eggs produced with in-ovo sexing technology, including around 50% of consumers who are “very” or “extremely interested. Overall, this data indicates that rather than kneejerk outrage to learning about the challenge of chick culling, consumers will feel more connected with brands and retailers that have taken the initiative to find a technological solution to the problem. Rather than consumer backlash, all the data we’ve seen points to eager enthusiasm.

When NestFresh’s first eggs produced with in-ovo sexing begin to hit the shelves in the US in the next few months, and when other producers and retailers roll out their own in-ovo sexed product lines, we expect consumer awareness of chick culling in the US to grow quickly. As this awareness increases, producers and retailers can capitalize on a growing purchase-ready audience.

Consumers will switch brands to purchase these eggs, including going to a different grocery store

A final and critical takeaway for producers and retailers is that because this issue can resonate so deeply with consumers, awareness of the issue will motivate consumers to switch brands or grocery stores in order to buy eggs. The NYT comments were filled with sentiments along these lines. Some commenters, like this one from Massachusetts, stated it directly: “I will only buy eggs from farms and producers with this technology.”

Others were less direct, but felt similarly. Merell said that she “will urge my grocers to switch to ovo-testing. I will share this article.” Similarly, Linda from Rhode Island said that she would “send a copy of this piece to every grocery store I visit starting next week.”

These sentiments are not surprising given the consumer survey data from around the world. One survey of UK consumers finds that nearly half of female consumers would be likely to switch grocery stores on the sole basis of whether they stock eggs using this technology.

Over the past decade, particularly in the US, consumers have increased their expectations around animal welfare. Producers, retailers, and food service providers that meet these expectations have seen higher brand loyalty. Over the next decade, this trend is set to continue, and the data suggests that in-ovo sexing is poised to become one of the most influential factors shaping consumer decisions in the egg aisle.